MACD and moving average scalping strategy | win rate: 86% +backtest

Imagine diving into the world of Forex trading with a strategy so simple, yet powerful, that it utilizes just two key indicators: the Moving Average (MA) and the MACD (Moving Average Convergence Divergence). Considered among the best indicators for trading, the Moving Average and MACD can create a compelling combination when used together. This is exactly what we will explore in this article – a straightforward and effective strategy using a 60-period Moving Average and MACD. Whether you’re a seasoned trader or just getting started, this strategy is designed to be versatile and accessible across all trading platforms, making it an ideal choice for anyone looking to enhance their trading game.

In this comprehensive guide, we’ll delve into one of the simplest yet most efficient strategies for trading. Known as a fast scalping strategy, it’s crafted for those who appreciate the art of quick, profitable trades. The beauty of this system lies in its simplicity; you only need a 60-period Moving Average and MACD to get started. By combining these tools, we’re setting the stage for what could be considered the best moving average for scalping, especially when aiming for quick, high-impact trades. So, if you’re eager to discover a profitable forex scalping strategy that’s both straightforward and effective, stay with us until the end of this article. We’ll also include the results of a backtest at the conclusion, providing you with a clear insight into the potential of this scalping system.

Overview of the Moving Average and MACD Trading Strategy

In the vast universe of Forex trading, the Moving Average (MA) and MACD (Moving Average Convergence Divergence) stand out as two of the most reliable indicators for traders across the globe. The Moving Average, a tool that smooths out price data to create a single flowing line, helps traders easily identify the direction of a trend. Whether you’re looking at a 15-minute forex trading strategy or a longer time frame, the Moving Average is incredibly versatile, adapting seamlessly to various trading styles and strategies. Meanwhile, the MACD, known for its ability to reveal changes in the strength, direction, momentum, and duration of a trend, is a favorite among traders who rely on its ability to signal potential entry and exit points.

These two indicators are more than just lines on a chart; they are the backbone of many trading strategies, including some of the best 1-minute scalping strategies. When combined, the Moving Average and MACD create a powerful synergy that offers traders a clear and concise picture of market conditions. This strategy, often referred to as the “moving average and macd strategy,” leverages the strengths of both indicators to help traders make informed decisions. By using the 60-period Moving Average to identify the overall trend and the MACD to confirm momentum, traders can enter trades with confidence, knowing they are aligning with the market’s underlying forces.

This strategy is not only simple but also highly effective across different time frames, making it a versatile tool for both fast scalping strategy enthusiasts and those who prefer longer-term trades. Its high success rate comes from the harmonious blend of the Moving Average’s trend-following capability and the MACD’s momentum-based insights, ensuring that you are always trading with the trend and never against it. Whether you are on the hunt for a simple scalping strategy for a quick profit or a profitable forex scalping strategy that can be applied to higher time frames, this approach offers the flexibility and reliability every trader desires.

Tools Needed for the Scalping Strategy with Moving Average and MACD

When it comes to setting up your trading chart for this scalping strategy, simplicity is key. You don’t need an array of complicated tools or software to get started. All you need are two of the most accessible indicators: the Moving Average (MA) and the MACD. These indicators are built into nearly every trading platform, making them easy to set up and use. The Moving Average helps you identify trends quickly, while the MACD gives you a clear signal of momentum changes, both essential for executing a profitable forex scalping strategy. It’s this simplicity and effectiveness that make it the best moving average for scalping, especially in the fast-paced environment of the forex market. With just these two tools, you can dive straight into a fast scalping strategy without any hassle, making it an ideal choice for traders looking for a simple yet powerful approach to the market.

Best Settings for the Moving Average Indicator

Setting up your Moving Average indicator for this scalping strategy with MACD couldn’t be easier. You don’t need any complex configurations—just a few simple adjustments will suffice. First, add an Exponential Moving Average (EMA) to your chart, which is known for being more responsive to recent price changes and ideal for a fast scalping strategy. Set this Moving Average to a 60-period, which helps in capturing the medium-term trend and complements the strategy perfectly. To enhance its effectiveness, you might want to change the “apply to” setting to the fifth option on your trading platform, which typically relates to the close of the price bar. As for the MACD, leave it on its default settings; this will provide clear momentum signals without any additional tweaking. By using these straightforward settings, you are well on your way to implementing a profitable forex scalping strategy that’s both simple and effective.

Ideal Time Frames for the Scalping Strategy with MACD and Moving Average

One of the greatest advantages of the moving average and MACD strategy is its versatility across different time frames. While this simple scalping strategy is particularly effective in the lower time frames, such as 1 to 15 minutes, making it the best 1-minute scalping strategy for those looking for quick profits, it doesn’t mean you’re limited to these settings. If you prefer to take a step back and have less time to monitor the charts continuously, you can also apply this profitable forex scalping strategy to higher time frames like the 4-hour or daily charts. This flexibility allows you to adapt the strategy to fit your schedule and trading style, whether you’re a fast-paced scalper or a more relaxed trader looking for consistency over a longer period.

How the Scalping Strategy with Moving Average and MACD Works

Now, let’s dive into how this powerful scalping system works with the moving average and MACD indicators. The beauty of this strategy lies in its simplicity and the clarity of its signals. Here, we’ll break down two trading setups—one for entering a buy position and one for entering a sell position.

Buy Setup

To enter a buy trade using this macd moving average strategy, watch for a candle to cross above the Moving Average line from below. However, before you jump into the trade, ensure that the MACD hasn’t yet switched to a bearish phase, and the signal line is still intertwined with the MACD histogram bars. This indicates that the price may soon rebound, offering a prime opportunity to go long. This setup is a cornerstone of a profitable forex scalping strategy, especially in lower time frames.

Sell Setup

Conversely, to enter a sell trade, look for a candle to cross below the Moving Average line from above. At the same time, ensure the MACD hasn’t yet shifted into a bullish phase, and the signal line remains close to the histogram bars. This situation suggests that the price might soon decline, presenting a good moment to open a short position. This method forms the backbone of a best moving average for scalping strategy, leveraging the early signals provided by both indicators.

Take Profit

The take profit level for this simple scalping strategy is set at 50% of the candle or wave that crossed the Moving Average line. This conservative target helps secure profits while minimizing risk, making it a great fit for a fast scalping strategy.

Stop Loss

As for the stop loss, it’s advisable to exit the trade whenever the MACD changes phase, signaling a shift in momentum. This dynamic stop-loss placement helps protect your capital by reacting to market conditions in real-time, which is essential for any effective scalping system. By closely following these setups and rules, you can make the most of this straightforward yet highly effective 15-minute forex trading strategy.

Key Tips for Trading with the MACD and Moving Average Strategy

By now, you’ve probably realized that trading with the MACD and Moving Average strategy is both simple and profitable. However, there are a few key points that can significantly increase your chances of success when using this scalping system.

First and foremost, pay close attention to the MACD signal line. The best time to enter a trade is when the MACD signal line has not yet separated from the histogram bars. This indicates that the MACD on lower timeframes has not shifted its phase in the opposite direction of the price movement. When the MACD signal line stays close to the histogram bars, it means there is still momentum in the current trend, suggesting that the price is likely to reverse soon. This is a vital aspect of the macd moving average strategy, ensuring that you are trading with the prevailing trend rather than against it.

Another crucial tip is knowing when to exit a trade. Although in many cases the price does reverse and hits our target, there are times when it does not. This situation often leads traders to hold onto their positions in the hope that the price will eventually come back in their favor. However, this mindset can be dangerous and is often what leads to margin calls. To avoid this, it’s essential to have a strict exit strategy in place. One such rule of thumb is to exit the trade if two consecutive histogram bars indicate a phase shift in the MACD after a trend change. This approach minimizes the risk of significant losses and ensures that you are not caught in a prolonged market downturn.

Furthermore, for those looking to employ the best moving average for scalping, it’s advisable to keep things simple. Overcomplicating your charts with too many indicators can cloud your judgment and lead to indecision. The beauty of this strategy lies in its simplicity; by focusing on just two key indicators, you can make quick, informed decisions that align with a fast scalping strategy. Remember, the aim is to capitalize on small price movements in a short amount of time. This means you need to be able to act swiftly, without second-guessing your trades.

Lastly, consistency is key. This strategy works best when applied consistently across similar market conditions. While it’s tempting to experiment with different settings or timeframes, sticking to the proven parameters will yield the best results. This consistency also helps in refining your skills and understanding how the moving average and MACD react in different scenarios. Over time, this familiarity will boost your confidence and enable you to execute the best 1 minute scalping strategy effectively, ensuring steady profits in the long run.

By keeping these tips in mind, you can maximize the potential of this moving average and MACD strategy, turning it into a reliable component of your trading toolkit.

Backtesting Results of the MACD and 60 Moving Average Trading Strategy

Backtesting is undoubtedly one of the most effective ways to gauge the performance of any trading strategy. At Pico Chart, in line with our mission to provide profitable and efficient trading strategies, we rigorously test each system before presenting it to our audience. We believe in transparency and accuracy, which is why we share our backtesting results openly, allowing traders to make informed decisions based on real data.

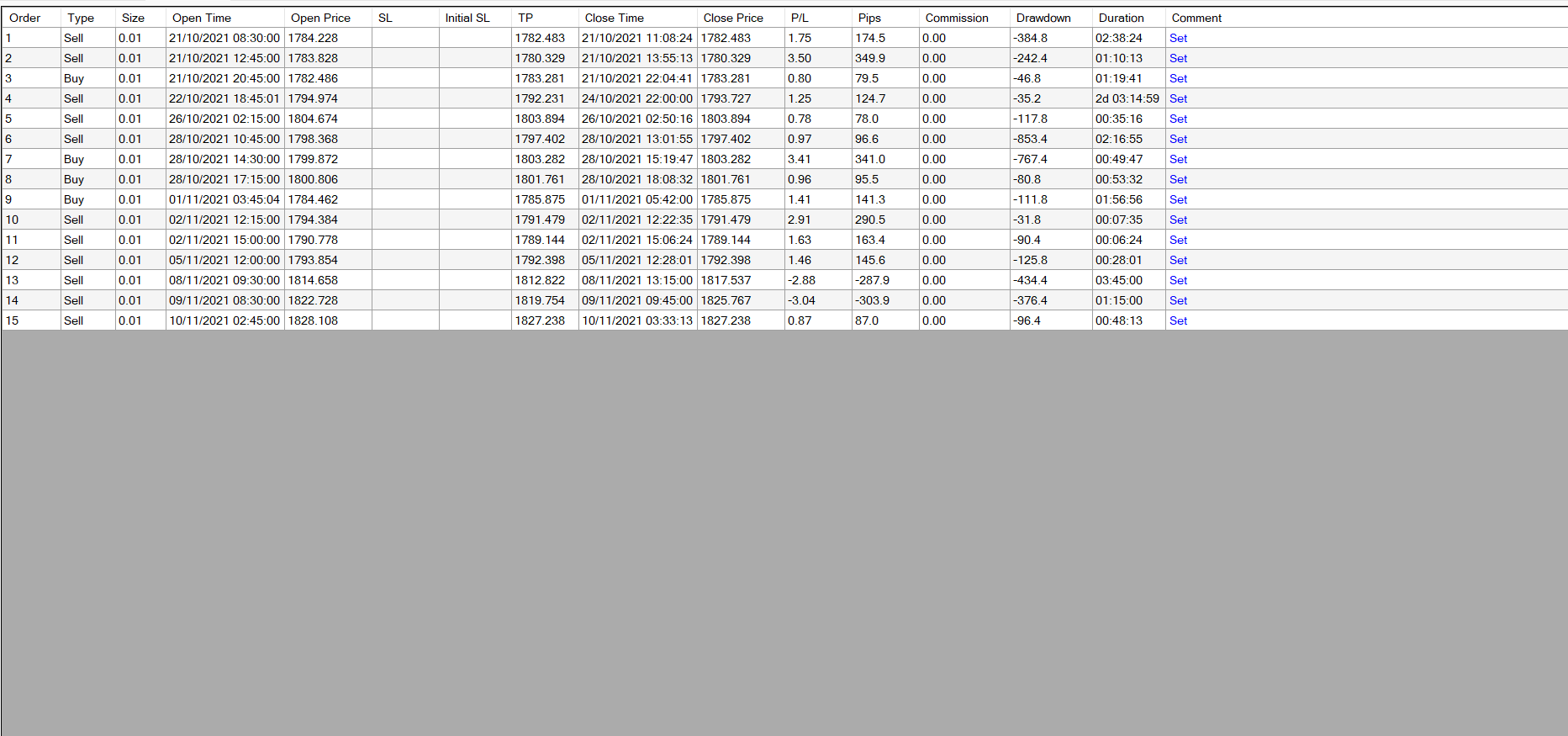

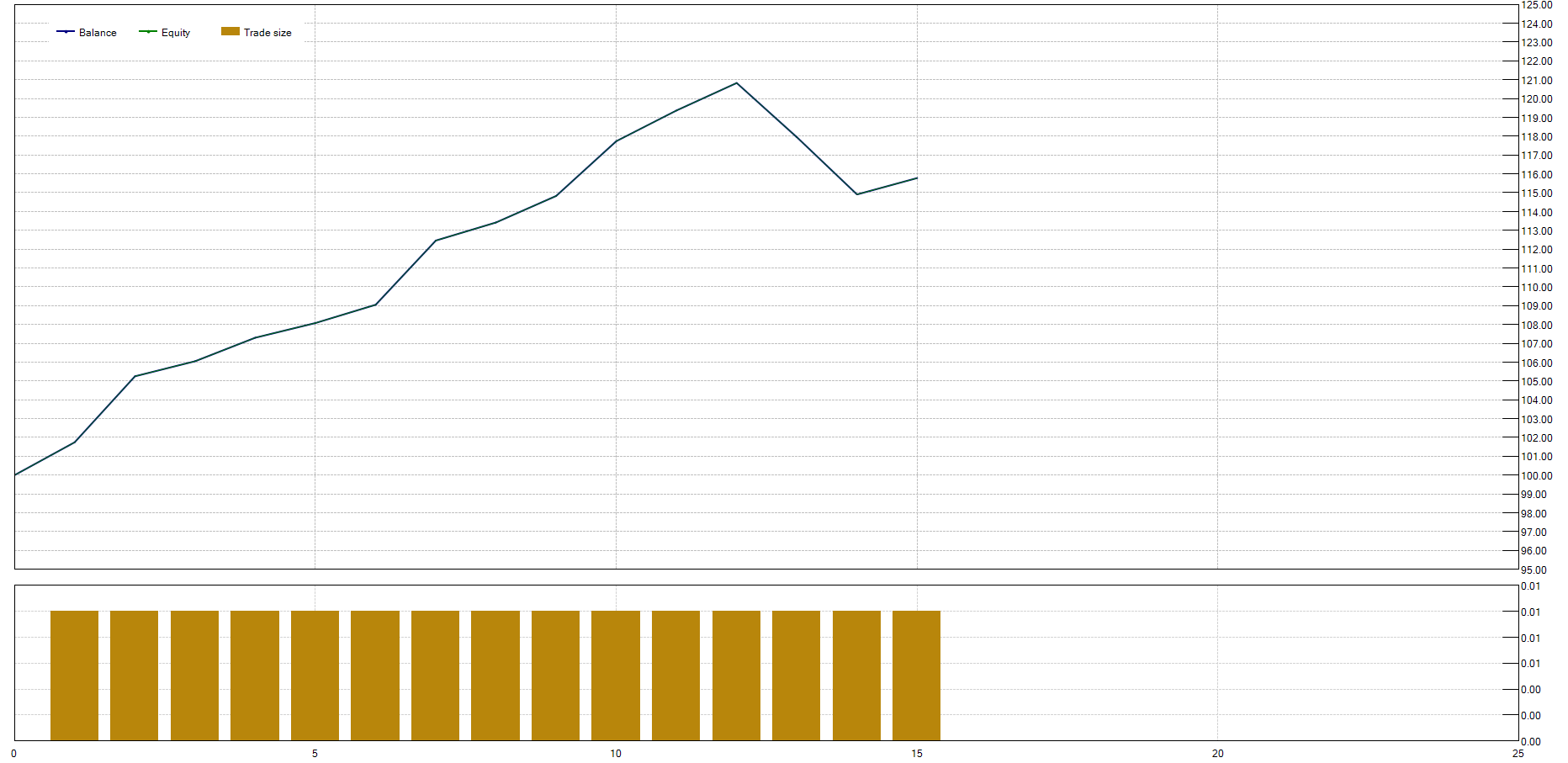

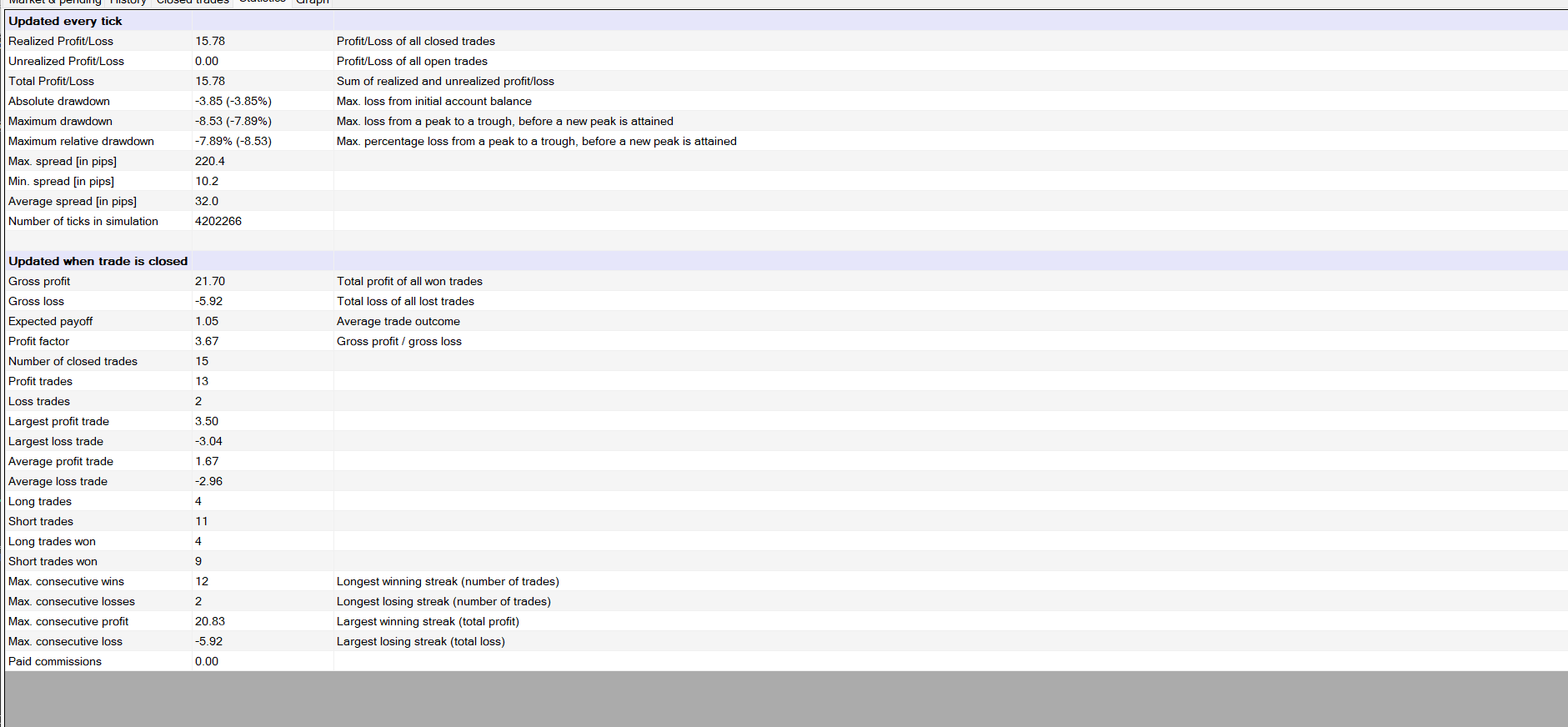

For our test, we applied the 60 moving average strategy combined with the MACD indicator on the XAUUSD currency pair. The test was conducted over a one-month period, from October 14, 2021, to November 14, 2021, using the 15-minute timeframe. The aim was to determine how effective this strategy is in a fast-paced trading environment and to assess its overall profitability and reliability.

As evident from the results, we executed 15 trades during this period, of which 13 were profitable and 2 were losses, resulting in an impressive win rate of 86.6%. What’s more, this strategy yielded a 15% profit in just one month on a single currency pair. The average profit per winning trade was $1.67, while the average loss per losing trade was $2.96. This means that even though the losses were nearly double the profits, the high win rate compensated for this discrepancy, highlighting the robustness of this strategy. Additionally, we maintained a conservative trading volume of just 0.01 lots, which can be adjusted upwards in line with an increase in trading capital.

However, it is crucial to remember that no strategy is without its risks. The fact that this system generated a profit does not guarantee future success. Market conditions are constantly changing, and what works today may not work tomorrow. Therefore, while the backtesting results are promising, we urge traders to conduct their own due diligence. Practice this strategy on a demo account, perform additional backtests, and refine it to suit your trading style and risk tolerance.

Finally, a word of caution: Pico Chart does not endorse or reject any specific strategy. Our role is to provide you with the tools and data you need to make your own informed decisions. Ultimately, the responsibility for any profits or losses lies with you, the trader. We encourage you to experiment, learn, and develop a strategy that works best for you, always keeping in mind the importance of risk management and continuous learning in the dynamic world of trading.

maybe useful for you:

kijun sen cross trading strategy

best HeikenAshi and TDI Strategy